For early-stage businesses, raising Series A funding is a big milestone. It gives financial breathing space and confirms the product and the plan. Yet stats show that more than a third of these start-ups never make it to Series B, falling at the first significant hurdle. In other words: only 65% of start-ups survive Series A and go on to reach Series B. By contrast, the fail rate after Series B is only 1%. So while Series A is important, arguably the most difficult path lies just beyond: on the road from A to B.

So how do you transform your business from an early-stage start-up to a young company that’s growing at scale? Smedvig Capital’s latest playbook, What happens after Series A? Building your business after the fundraise, gives some great insights into how to navigate this challenging period. Aimed at CEOs, their booklet is divided into chapters devoted to the nine key areas and themes any leader needs to consider when growing their business, from sales to marketing, customer success and sales, product, tech, people, finance and, lastly, the founder-CEO themselves.

Smedvig Capital is a London-based investor and advisor with over 25 years of experience helping mid-stage start-ups grow and succeed. They focus on the UK, the Nordics and the Netherlands, and have funded over 75 companies and delivered 54 to exit. Below we condense some of the key learnings from the booklet into three hot takeaways so your start-up can survive after Series A.

Transition From a Set of Founders to C-Suite

What this means is: after securing the first funding milestone, founders should move away from working in the business to working on it. This means founders should take a moment to analyse their strengths, their weaknesses and then hire management roles to plug the gaps in their skill sets. The key here is to surround yourself with brilliant people through clear and impersonal delegation. The right person for the right role.

This process is important and shouldn’t be rushed. Founders need to spend time honestly analysing themselves and their team; they need to hire carefully and they need to hire well. This important step is aimed at building solid foundations for the next stage of your business’s growth.

Immediately Prep for Series B

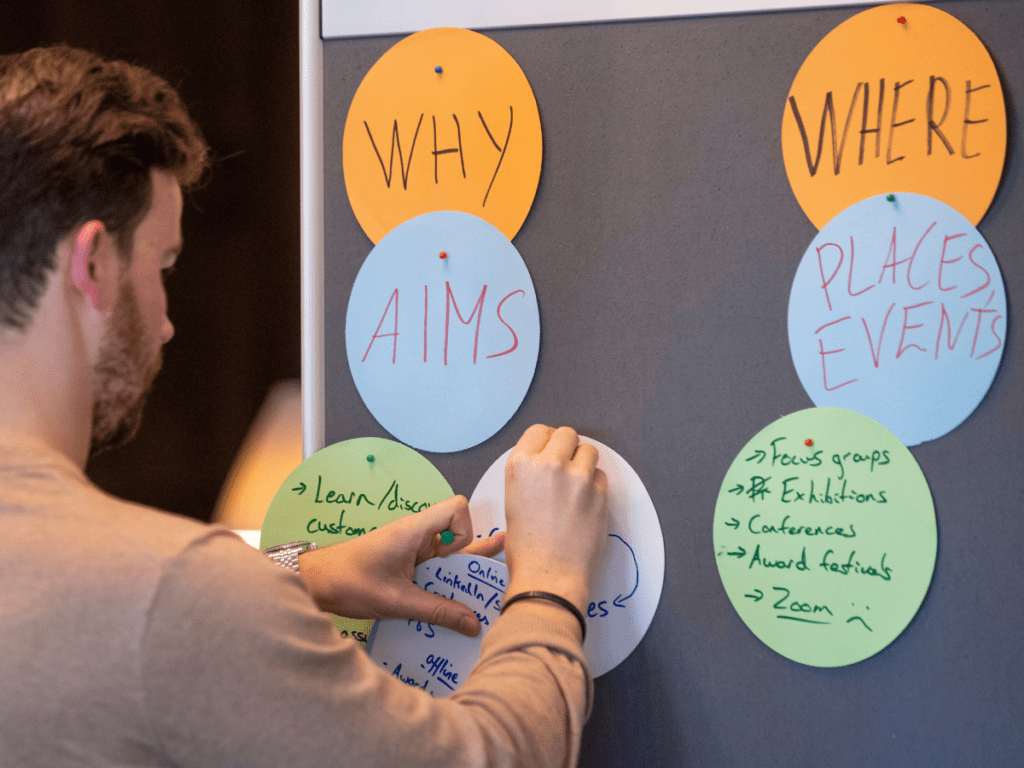

By contrast, what founders need to do rapidly and immediately after securing Series A is two things: one, write a pitch deck for Series B; and two, create an internal one-pager on the business. The one-pager brings clarity to what the business is and does, why the team is doing it, what value it brings, what problem it solves and why it all matters. It is the who, what, where, why and how of the business and helps bring clarity to where your business currently is.

For the pitch deck, the founder(s) and key management team should each define 10 bullet points that everyone wants to write again in two years’ time. If you begin building around these points – imagining how you’ll finance, plan and structure this growth – then you’ll actually get there. In short: The one-pager shows you what’s happening right now; the pitch deck shows the direction you’re going.

Engage Advisors, Investors and Their Networks

It’s often been characterised that between A and B, you’re (re)building your plane mid-flight. Even the smartest founders will make mistakes at this key point in the learning- and business process. So engage your network!

Talk to your investors, speak with accelerators you might have worked with and fire up those emails from advisors you met at conferences, summits and casual start-up meetups. They have helped hundreds of founders and senior leaders like you and they can help you here. They can help you hire the right people, break complicated or daunting things down, and give you the space you need to step back and take stock. They will also help you avoid mistakes and, if you make some mistakes, help you draw new strengths and the right lessons from each experience.

Get Additional Tips

Ultimately, every founder’s journey is different. And circumstances can change which are unforeseeable and unavoidable. But by following these three points immediately after you’ve finished celebrating your Series A win, you’ll be putting in some solid foundations that will ensure your company survives well into Series B funding and beyond. For an in-depth guide on how to survive and thrive in this crucial stage of your business, download Smedvig Capital’s latest playbook, What happens after Series A? Building your business after the fundraise.

This article was adapted from Maddyness and Smedvig Capital. Read the in-depth piece and interview at Maddyness here.